Dear SGWiseInvestors Fans and Readers,

We must know what is the problem around the world. Currently we can say that the fundamental of the world outlook is weak. WE NEED CATALYST AND WE HOPE TO SEE THAT ON 22TH JANUARY 2015.

Last Week events

There are so many turmoils in the stock market and this will carry on this weeks.

Lets round up what happen last week. The continuation of the slumping of crude oil to below 45 after Goldman Sach downgrade of the crude oil outlook. To make the matter worse, Swiss National Bank has decrease the interest rate from negative 0.25 to negative 0.75. This surprise announcement has created fear and caused great volatility in Swiss Franc and of cause to the stock market to resume the Short Term Downtrend. FXCRM has incurred big losses of over USD200million and this causes the plunge in the price of the stocks. IG has incurred losses of USD30million. Citibank has incurred about USD150million loss. CMC announced that the loss in the Swiss Franc is not affecting the strong balance sheet.

Bonds Market

The treasury bill bonds yield are the highest and we are still not seeing the price of the bonds at the highest. This is creating so much inbalance and alot of banks are taking great precautions and reducing their exposure. Russian bonds and also other emerging bonds prices are plunging and some even defaults. OAS bonds are at the brink of defaulting after missing payment. They are currently restructuring its loan to repay the client. Fantasia bonds, Caesar Entertainment, etc are some bonds that defaults. Looks like the stronger will survive.

This week events

We are back to Euro's Draghi again. On the 22th January 2015, there will be announcement whether if the Euro central bank will be resuming to QE. The size of the QE ( previously was 1 Trillion) and the lack of the participation of QE will create more volatility and continuation of the downtrend of the US stock market.

Forecast of stock market for 19 January to 22 January 2015.

We are expecting great volatility this week and we will like to advise our readers and fans to trade with caution. This week is dependent on what Draghi will announce thus days before 19 January to 22 January 2015 is much or less predictable.

Friday's market rebounded from loss to close off with positive note +191. We are seeing temporary rebound and at the 38.2% Fibonacci retracement. This is currently the strong support and short term wise we should see a rebound. Will we break this strong support? SGWiseInvestors thinks that it is possible if the announcement on QE is not favorable. Let us see.

INDU

Look at the bounce at 32.8% retracement 17,236, we are seeing a strong buying with volume increased . Long white candle indicated that this is where the support is. RIS indicated that ST support has been found and it is crawling up now. We should see this few days in green till 22 February 2015.

VIX

VIX indicated that it is at its high. We expected to see it dipping down. Thus we should see green the next few days. This support the stock term rebound in INDU.

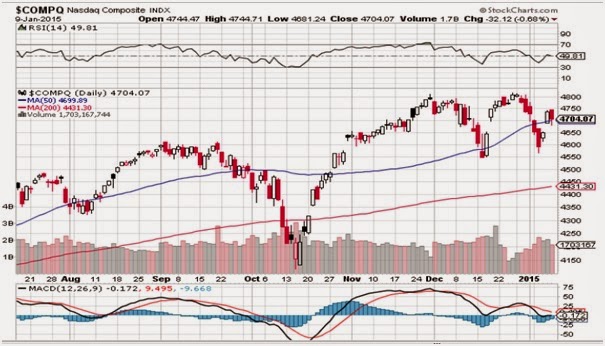

NASDAQ

We are seeing strong rebound in NASDAQ as well. It should rebound to 4800 by 22th January and whether can breakout we will have to see what Draghi announcement.

Crude Oil

Crude oil gas found the temporary support at 45. We should see this bounce back to 60. however do note that we are still in strong downtrend. It is still possible that we can go down lower to 40.

Gold

WOW.. Gold is going higher with issues from EUR, Swiss National Bank annoucement etc. The recent bar shows a decrease in volume. Thus we should see short term retracement soon to 1255.49 before further uptrend is resume.

USD

The uptrend is likely to resume. There is a breakout in USD but it was dipped to within the range. There is high possibly that we will see continuation of the uptrend of USD.