Dear all fans and readers of SGWiseInvestors,

Yesterday is a super day for Traders as we witness continuation of selling of energy stocks that led to Dow loss. Gold which is a gauge of sentiment for fear inches up and closed at 1,229. NASDAQ closed on positive note. Penny stocks lead the Dow and trims the loss and closed at 51 points. We can see that although there are no reversal yet but we can say that there are buyers at this support level at 17,801. We will have to see today’s candle to confirm on the reversal or continuation of the ST downtrend.

From the above chart, we can say that there are absorption volume at 17,600 and this is a big support at the moment. This is accompanied by high volume and believe that today will be a higher probability that market will be going higher.

XAU - Gold

Is Gold heading up or down? Gold increased the past few days and I did indicated earlier on that Gold is going to soar to around 1221. However, we can see the increase in volume. This shows that the fear of the oil issue is not over yet. We may expect some news soon. We should see gold testing 200SMA at 1271. If the increase in volume persist, then we should see it test 1300 in the near term.

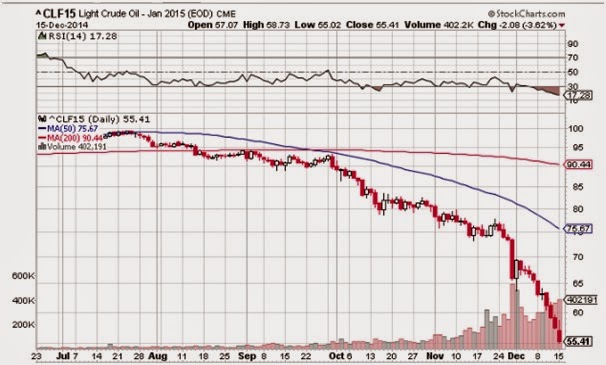

Brent – Brent Crude Oil

What happened to Brent Crude Oil!? It's heading downwards again? Yesterday we witness bounce in $Brent and this led to Dow Jones trim its loss. Will we see it bouncing up? The chart is not looking good and yesterday bounce is accompanied by only average volume. We hope to see more volume coming in and this may lead to reversal. At the meantime, any bounce is for more short. We may see the bounce to 76 to close gap and thereafter further downtrend to continue.

China Stocks round-up

WUBA - 58.com

Emerging buyers! Let us touch on the first stock, WUBA. This stock is likely to bounce higher. This stock dip to below 42 and closed with a white candle on the upper wick. The only worrying about this stock is there is no high volume during the absorption. Thus we have to wait on wed closing candle to determine if this is a buying signal.

BABA – Alibaba

If you did follow our post for BABA, you will be able to link them all together. And now, is this a buy signal for us? This stock has found support at 101.25 and bounce off, closing at 107.48. The volume shows increase in buyers. The candle body is wide and this shows the bullish sentiment of the stock. We believe that the stock has reversed and is on the way to higher high. The first resistance is at 110 and subsequently is 115. If the stock is bullish enough, this stock will test 120 in no time and making ALL time high.

Qihu – Qihoo

This counter is going to bounce like on a trampoline? This is a counter-trend approach. Meaning to say, the stock is currently in the downtrend and traders are targeting fast profit. This kind of risk is higher as traders are catching falling knifes. Predicting the bottom. But if the prediction is correct then this will a huge profit for the risk taker.

FB - Facebook

What about Facebook? Can we buy now? One of my followers in Stocktwits ask me about this stock and whether if it is time to enter. The answer is NO. There is no buy signal yet. Investors who is afraid to lose boarding the train and do not mind locking their funds can buy in this stock at support price 72-74 range. For Breakout trade, look for about 78 to enter. Do note volume must be high (about twice the current volume).

TWTR – Twitter

Another counter-trend play. This stock is currently in the downtrend. Yesterday price action has indicated that bottom has reached. The support is at 34.62. It closed with wide body and at the upper wick of the candle stick. Volume is quite decent. If volume is to come in, together with more buyers, we should see it closed gap at 46-48 before continuation of the downtrend.

AAPL – Apple

Has APPL reached the support required? One of my followers in Stocktwits ask me about this stock and whether if it is time to enter. The answer is YES. There is buy signal yesterday. Bottom/ support is at around 110. If the stock is closing on a positive note today, we can expect this stock to gain strength and test 120 once day.

TSLA – Tesla Motors Inc

Heading up or down at the bottom? Support is at 205 and we should see this stock bounce to around 231-240 and downtrend will resume. Unless we see buyers coming and increase in volume. Else we should see more downside for this stock.