Dear SGWiseInvestors Reader and Fans,

Last week and yesterday has been a volatile week. Readers have came back and ask me if the market is going to tank or is it a buying in dip opportunity. Seriously based on my 10 over years of experience this is a buying in dip opportunity. Why? Gold is a safe heaven commodities and is a good gauge for fear. When the market is about to tank, have used this tools "Fibonacci Retracement" to determine the support and buying pressure that may come in. Yesterday was a test of 61.8% support at 17,169. There is selling pressure that pushes the market to low of 17,115 and closes at 17,180. If today the market holds at this support (which is unlikely), we should be heading up for a rally.

I believed that we should be testing at 50% support 16,915. I can see that RSI is indicating that there are still some room for one or two more falls and we are heading for Christmas Rally. I do note there will be FED meeting this Thursday and this may be a triggering point for the rally. FED may announce something doverish to boost the market and to lure more traders into the market. (they cannot possibly scare all investors out of the market, then how are they going to make money).

I do notice that Dow Jones are now heavily linked with Crude Oil. There is no need for any good/bad news to be catalyst. If the Crude Oil rebound, the stock market will re-live. But whether if it is short lived or not, let the volume tells you.

Dow Jones – Where are we heading?

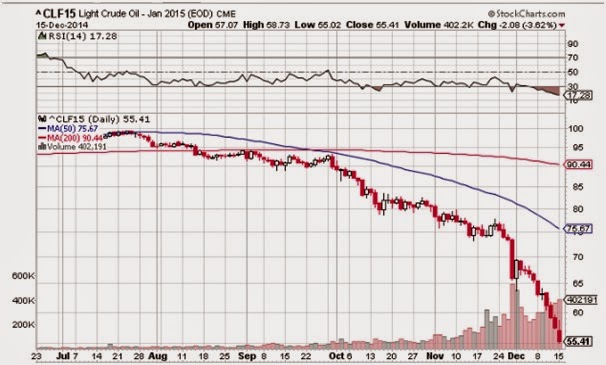

CLF15 – Light Crude Oil

Commodity Crude Oil is the culprit for bringing down the whole stock market. The above chart show a nice downtrend since 06 Oct 2014. This is accompanied by increase in volume. Technically this means that there are genuine selling by Smart Money and they have not seen the price that they want yet. Thus there is no rebound or up candle stick. Target Price for Crude Oil should be around USD48. That will be one big strong support that we are looking at. Currently we can say that downside are more favourable in the short run until good news/ announcement comes in.

Gold – Is it heading North or South?

Gold from the above chart shows that it is currently on the uptrend. This is probably due to increase in fear from Crude oil commodity bringing the stock market down. Yesterday decrease of about 29 points is currently in the support of 30SMA support. We should see absorption volume coming in at this point if the upside will to resume. Else we should see it retesting 1140 soon.

Daily Chart and Weekly Chart for $Brent is attached. Currently the daily chart and weekly chart is showing that it is overbought. There is no floor yet thus there is no indication where is the bottom. Yesterday increase in volume in selling indicated that there are a lot of people selling their shares. We can say that there are increase down pressure as indicated from the volume. Whether when will we reach the bottom, only volume and price action will tells.

No comments:

Post a Comment