Dear SGWiseInvestors Reader and Fans,

Quick roundup of last Friday price action and volume analysis.

The volume is lower than the previous two days and the dip is now resting at 50MA. 10MA and 30MA narrows and there may be further dips as RSI is showing it resting at support 50.86. What can we expect? Our forecast is that it will bounce and heading for RSI 70. Stochastic is showing that there is possibility of the trend continuing upwards. This is possible especially with low volume and we are at the 4th quarter earning with Alcoa being the first company to report earnings after end of today trading hours.

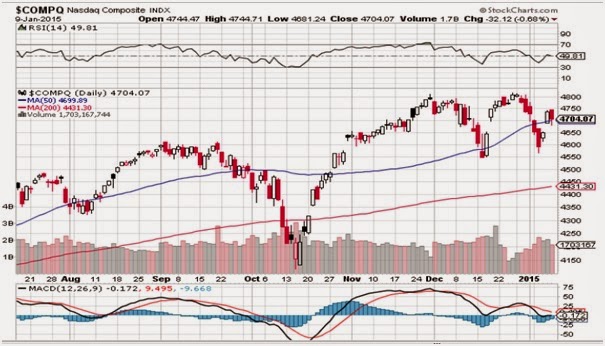

NASDAQ is resting at 50MA and at RSI support 49.81. Volume is low as compared to the previous two days. The wick is showing that there are some buying as well. However, last Friday price action shows that it is dominated by the bear. If today we see white candles then we are going higher and we should be breaking high of 4800 soon.

Crude Oil – WTI

We should see this going lower. Bottom yet? Not yet. It should be reacting only when reach 40 or even below. Lets see.

XAU - Gold

Moving Higher? Yes. We should be seeing it move higher. Once it crossed the 200MA at 75.13, we should see further upside. This is due to Crude oil fear and also issues at Europe side.

USD

Is USD going higher? USD is set for abit of pullback with RSI crawling downwards. We may see the USD fall to support at 91 before the next up leg. Nice uptrend indeed. We should see it hitting 100 psychological barrier in months to come.

No comments:

Post a Comment